Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

SBI Personal Loan EMI Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

SBI Personal Loan Emi Calculator :

SBI (State Bank of India) is one of the leading banks in India and offers a range of financial products and services to its customers. SBI personal loans are one of the most popular financial products offered by the bank. This blog post will provide detailed information on SBI personal loans, including their features, eligibility criteria, documents required, and more.

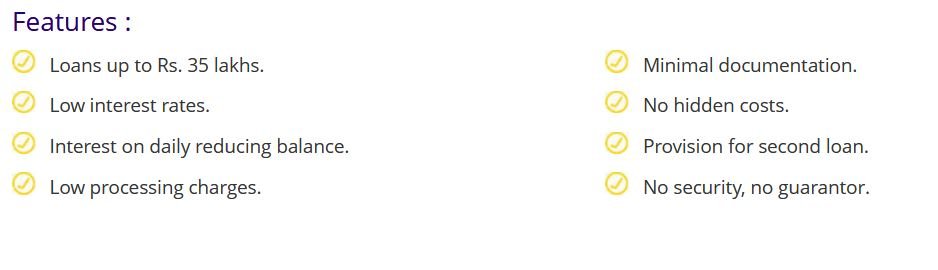

Features & Benefits of SBI Personal Loans – 2023

SBI personal loans come with various features that make them attractive to customers. Here are some of the key features of SBI personal loans:

-

- Loan Amount: SBI offers personal loans ranging from Rs. 1 Lakh to Rs. 20 lakh.

-

- Interest Rate: SBI personal loans come with competitive interest rates, starting from 9.60% per annum.

-

- Loan Tenure: The loan tenure for SBI personal loans ranges from 12 months to 72 months.

-

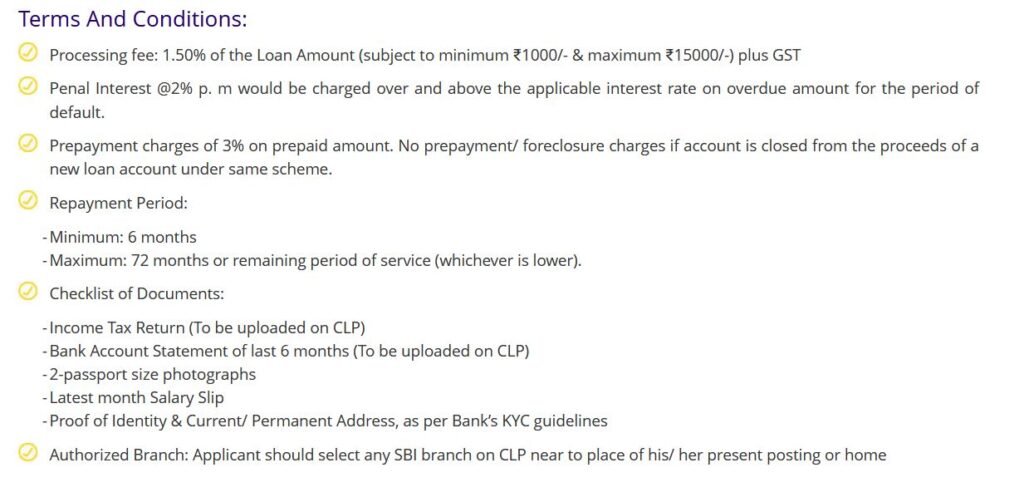

- Processing Fee: SBI charges a processing fee of 1% of the loan amount.

-

- Prepayment Charges: SBI allows prepayment of the loan, and there are no prepayment charges for loans with floating interest rates. For loans with fixed interest rates, prepayment charges are 2.25% of the outstanding loan amount.

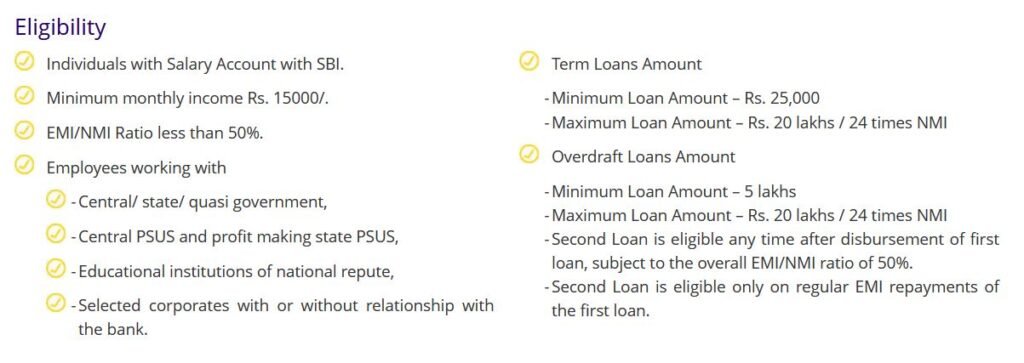

Eligibility Criteria for SBI Personal Loans

To be eligible for an SBI personal loan, you need to meet the following criteria:

-

- Age: You should be between 21 and 58 years of age.

-

- Income: Your net monthly income should be at least Rs. 15,000 for metro and urban areas and Rs. 10,000 for rural and semi-urban areas.

-

- Employment Status: You should be a salaried individual working in a government or private organization.

-

- Credit Score: You should have a good credit score, preferably above 750.

Documents Required for SBI Personal Loans

To apply for an SBI personal loan, you need to submit the following documents:

-

- Pan Card

-

- Aadhar Card

-

- Address Proof ( Aadhar Card, Voter Card, Ebill, Postpaid Bill, Landline Bill, Passport, Driving Licensee )

-

- 3 Month Pasylisp

-

- 6 month Bank Statement

-

- 2 Year Form 16 ( If Salary Account Another Banks)

-

- Office ID Card

How to Apply for an SBI Personal Loan?

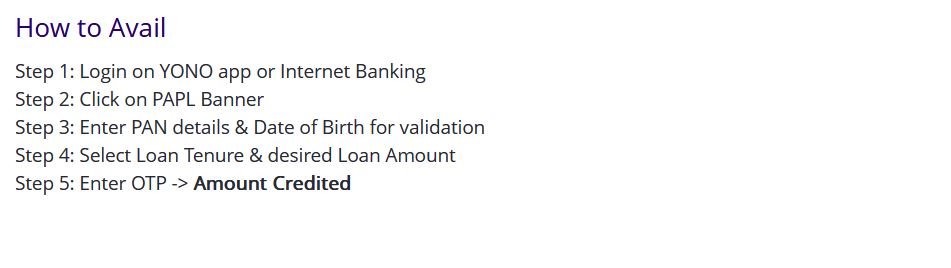

You can apply for an SBI personal loan online or offline. Here are the steps to apply for an SBI personal loan online:

-

- Visit the SBI website and navigate to the personal loan section.

-

- Fill in the loan application form with your personal, employment, and income details.

-

- Upload the required documents and submit the application.

-

- The bank will verify your documents and credit score.

-

- Once your application is approved, the loan amount will be disbursed to your bank account.

Alternatively, you can also visit the nearest SBI branch to apply for a personal loan offline. You need to fill in the loan application form and submit the required documents.

Read Also :

How Types Personal Loan Provided By SBI Bank- 2023

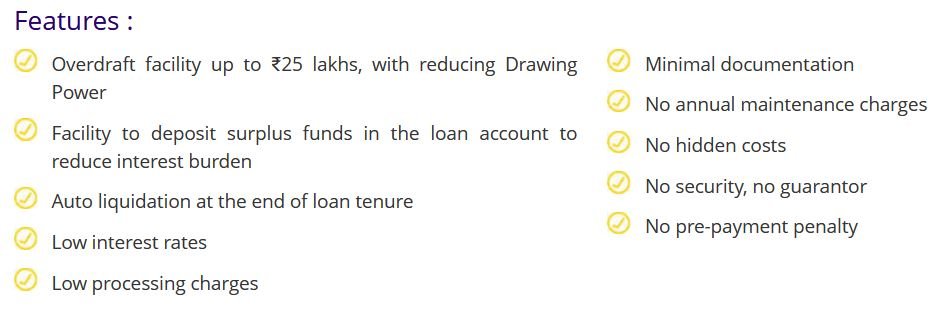

1 – SBI Xpress Flexi Loan :

SBI has developed a personalized Overdraft Personal Loan solution aimed at all salaried customers earning a monthly salary of ₹50,000/- or higher. With the SBI Xpress Flexi Personal Loan, you can access an Overdraft facility that allows you to withdraw funds as and when required, whether it’s for a wedding, vacation, unplanned emergency or planned purchase.

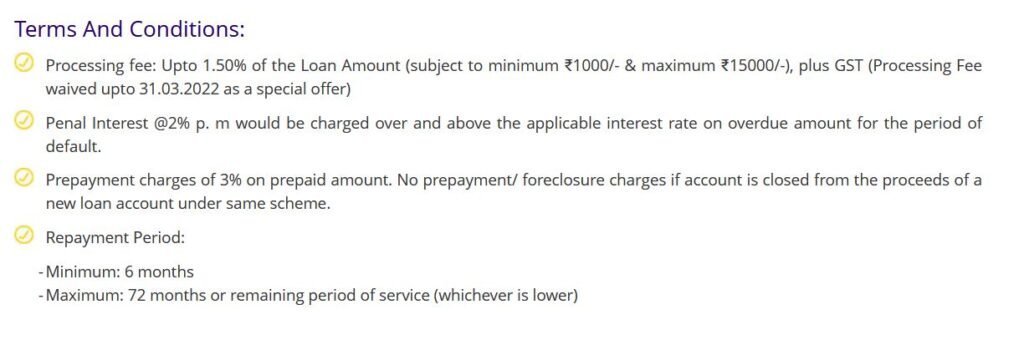

Terms and conditions for the loan:

-

- Processing fee: Up to 1.50% of the loan amount (with a minimum of ₹1000/- and a maximum of ₹15000/-), plus GST. However, the processing fee is currently being waived as a special offer until 31.01.2023.

-

- A penal interest rate of 24% p.a. will be charged over and above the applicable interest rate for any overdue amount during the default period.

-

- The repayment period for the loan is a minimum of 6 months and a maximum of 72 months, or the remaining period of service (whichever is lower).

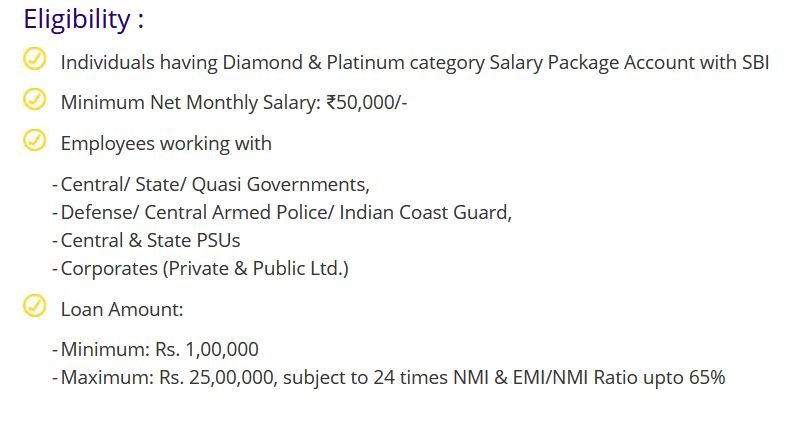

2 – Personal Loans to Salaried Employees having salary accounts with SBI

For all your financial requirements, including your wedding, vacation, unplanned emergency, or planned purchases, you can receive prompt approval and immediate disbursal with minimal documentation through SBI’s Xpress Credit Personal Loan.

3 – Pre Approved Personal Loans on YONO SBI

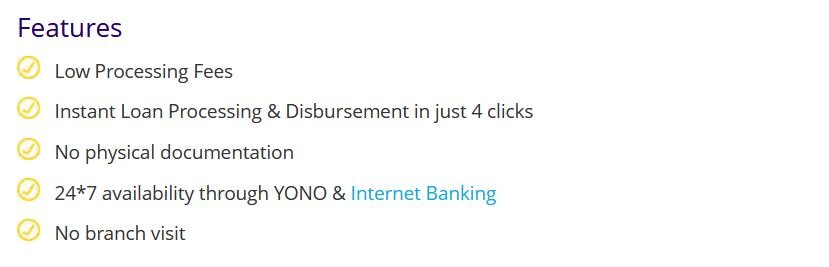

Owning an account with SBI is now more advantageous! With the YONO app or internet banking, you can apply for pre-approved personal loans instantly, at your convenience, 24/7, in just four clicks.

However, at present, this loan is available to a specific group of customers who have been pre-selected based on predefined parameters.

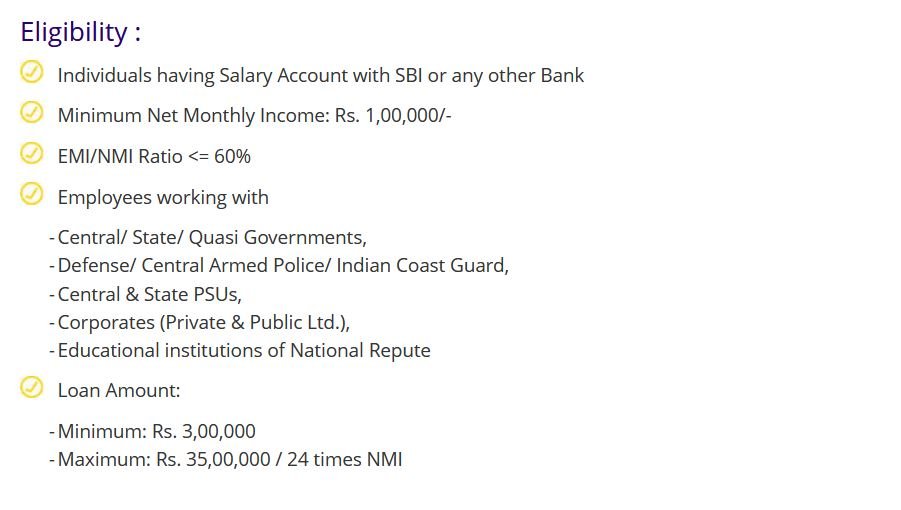

4 – Personal Loans to Salaried Customers not maintaining Salary Account with SBI

SBI has designed a Personal Loan for you, regardless of where you hold your Salary Account. Whether you need funds for your wedding, vacation, an unplanned emergency, or a planned purchase, you can obtain quick approval with minimal documentation through the Contactless Lending Platform (CLP).

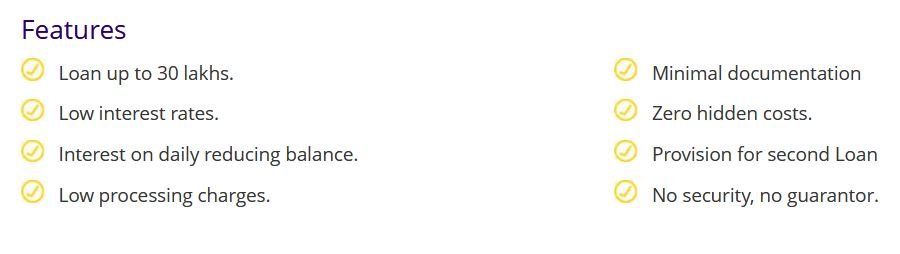

5 – SBI Xpress Elite Personal Loan

SBI has tailored a Personal Loan specifically for high-value salaried customers with a monthly income of ₹1 lakh and above. Whether you require funds for a wedding, vacation, unplanned emergency, or planned purchase, you can obtain quick approval and disbursal with minimal documentation through the SBI Xpress Elite Personal Loan.

Conclusion

SBI personal loans are a great option for individuals looking for financial assistance. With competitive interest rates, flexible repayment options, and easy eligibility criteria, SBI personal loans are a popular choice among borrowers. So, if you need funds for personal expenses, such as home renovation, wedding, or medical expenses, consider applying for an SBI personal loan.